Best auto insurance companies for teens and young drivers

Young drivers and teenagers often face premiums up to 300% higher than older drivers. Companies like State Farm, Erie Insurance, and Geico offer competitive rates and are popular choices for those new to driving.

Observing a teenager take the wheel for their inaugural drive can be a blend of excitement and anxiety. Discovering the insurance rates for teenage drivers usually leans towards the latter. So, what makes insuring young drivers so costly?

In this piece, our MarketWatch Guides team delves into the insurance requirements for teens and young drivers, exploring the elements that impact the price of an auto insurance policy. We’ve extensively evaluated various providers to identify best car insurance companies, and we’ll share our recommendations on coverage options as well.

What Does Car Insurance Cover for Teens and youth?

While you might come across terms like “teen driver insurance” or “youth car insurance,” there’s no specific insurance policy exclusively for teenagers. Whether the driver is 16 or 96, they must meet their state’s minimum liability insurance requirements. If the vehicle is financed, the lienholder will likely mandate collision and comprehensive coverage.

Which Insurance Coverage is Ideal for Teen and Young Adult Drivers?

Choosing the right insurance coverage for young drivers involves understanding the fundamental coverage options available in auto insurance. The following sections outline essential details about each primary coverage type:

Liability Coverage for Young Drivers

Whether you’re securing insurance for a teenage driver or getting coverage as a novice driver yourself, understanding the various insurance types is crucial. Virtually every state mandates some level of liability car insurance, which compensates for damages to others when you’re responsible for an accident. The primary components of liability coverage include:

- Bodily Injury (BI) Liability: This covers medical expenses, lost wages, and other costs for individuals injured due to your fault in an accident.

- Property Damage (PD) Liability: This covers damages to someone else’s property, such as their vehicle, when you’re at fault in an accident.

The required minimum liability coverage varies by state. For instance, drivers in North Carolina are mandated to have 30/60/25 coverage, meaning the policy would cover up to $30,000 per person for bodily injury, $60,000 per accident for bodily injury, and $25,000 per accident for property damage.

Collision Insurance for Teen and New Drivers

Collision insurance safeguards your vehicle against damages resulting from a collision, irrespective of fault. While state laws don’t necessitate collision coverage, lenders typically mandate it for financed vehicles to safeguard their investment.

This coverage reimburses you for damages to your car, offering compensation up to the vehicle’s actual cash value (ACV) if it’s declared a total loss. However, collision insurance excludes damages incurred in stationary situations.

Instances requiring a collision insurance claim might include:

- Striking a guardrail

- Collision with another vehicle

- Damage from road hazards like potholes

Comprehensive Insurance for Teen and Young Adult Drivers

Comprehensive insurance is often required for drivers who finance their vehicles. Unlike collision insurance, comprehensive coverage focuses on damages from non-collision incidents.

This coverage compensates for damages resulting from:

- Collisions with animals

- Environmental damage (such as floods, hail, fire, or tree sap)

- Damages from falling objects

- Theft or vandalism

Other Car Insurance Options for Young Drivers

Other insurance policies to consider include:

- Gap Insurance: This covers the remaining balance of an auto loan if the vehicle’s ACV payout falls short.

- Medical Payments (MedPay): This covers medical expenses for the driver and passengers.

- Uninsured/Underinsured Motorist (UM/UIM) Coverage: This offers added financial protection in accidents where the at-fault driver is uninsured or lacks sufficient coverage to pay for damages.

What’s the Cost of Car Insurance for Teens and Young Drivers?

Based on our estimates for full coverage rates, the average annual car insurance cost for teenagers is around $5,298, translating to approximately $467 per month. Insurance premiums tend to be higher for teenage drivers compared to other age brackets for various reasons, which we’ll delve into below.

Insurance Premiums Across Age Groups

Here’s a comparison of car insurance rates for young drivers versus other age demographics:

| Age | Monthly Car Insurance Estimate | Average Annual Car Insurance Estimate |

|---|---|---|

| 16 | $576 | $6,912 |

| 17 | $468 | $5,612 |

| 18 | $413 | $4,958 |

| 19 | $309 | $3,708 |

| 21 | $232 | $2,786 |

| 25 | $168 | $2,019 |

| 30 | $153 | $1,831 |

| 35 | $149 | $1,785 |

| 40 | $146 | $1,755 |

| 45 | $144 | $1,730 |

| 50 | $138 | $1,658 |

| 55 | $134 | $1,609 |

| 65 | $137 | $1,648 |

| 75 | $159 | $1,912 |

Note: Costs are based on 2023 rate data.

Car Insurance Rates for Teens and Young Drivers: Rates by State

Hawaii and Vermont provide affordable car insurance options for 16-year-old drivers, whereas 21-year-old drivers can find the most competitive rates in Nebraska and Ohio. Location is a key factor influencing insurance premiums for drivers across all age groups.

| 16 | 17 | 18 | 19 | 21 | |

|---|---|---|---|---|---|

| Alabama | $6,425 | $5,636 | $4,930 | $3,386 | $2,380 |

| Alaska | $5,633 | $4,665 | $3,963 | $3,026 | $2,217 |

| Arizona | $6,879 | $5,754 | $4,935 | $3,601 | $2,856 |

| Arkansas | $6,347 | $5,079 | $4,456 | $3,136 | $2,391 |

| California | $6,077 | $5,694 | $5,401 | $4,061 | $3,282 |

| Colorado | $7,212 | $5,925 | $5,140 | $3,628 | $2,713 |

| Connecticut | $14,981 | $11,527 | $9,889 | $7,540 | $5,357 |

| Delaware | $10,461 | $8,026 | $6,961 | $5,096 | $3,363 |

| Florida | $12,130 | $9,986 | $8,802 | $6,138 | $4,576 |

| Georgia | $7,195 | $6,034 | $5,143 | $3,855 | $2,837 |

| Hawaii | $1,969 | $1,951 | $1,951 | $1,845 | $1,819 |

| Idaho | $3,988 | $3,077 | $2,770 | $2,423 | $1,895 |

| Illinois | $4,845 | $3,808 | $3,397 | $2,379 | $1,733 |

| Indiana | $6,168 | $4,634 | $4,061 | $3,206 | $2,336 |

| Iowa | $4,569 | $3,589 | $3,186 | $2,710 | $2,074 |

| Kansas | $5,622 | $4,688 | $4,152 | $3,122 | $2,274 |

| Kentucky | $6,638 | $5,659 | $4,936 | $3,733 | $2,802 |

| Louisiana | $12,974 | $9,413 | $8,324 | $5,997 | $4,677 |

| Maine | $3,801 | $3,342 | $2,990 | $2,485 | $1,756 |

| Maryland | $7,095 | $6,245 | $5,420 | $4,411 | $3,169 |

| Massachusetts | $9,994 | $8,318 | $7,858 | $5,630 | $4,818 |

| Michigan | $15,189 | $11,518 | $10,489 | $7,810 | $6,257 |

| Minnesota | $5,011 | $4,003 | $3,663 | $3,325 | $2,508 |

| Mississippi | $5,791 | $5,248 | $4,484 | $3,252 | $2,399 |

| Missouri | $6,401 | $4,960 | $4,305 | $3,551 | $2,736 |

| Montana | $7,330 | $6,412 | $5,865 | $4,459 | $3,283 |

| Nebraska | $3,812 | $3,089 | $2,843 | $1,668 | $1,552 |

| Nevada | $5,796 | $4,150 | $3,735 | $2,653 | $2,054 |

| New Hampshire | $6,074 | $4,775 | $4,272 | $3,249 | $2,475 |

| New Jersey | $5,879 | $4,803 | $4,052 | $3,055 | $2,349 |

| New Mexico | $8,895 | $6,996 | $6,058 | $4,324 | $3,189 |

| New York | $5,787 | $4,548 | $4,014 | $2,983 | $2,363 |

| North Carolina | $9,645 | $7,800 | $6,826 | $4,717 | $3,527 |

| North Dakota | $7,995 | $7,217 | $6,387 | $5,059 | $4,088 |

| Ohio | $3,637 | $3,172 | $2,762 | $2,234 | $1,696 |

| Oklahoma | $5,978 | $5,242 | $4,759 | $3,438 | $2,671 |

| Oregon | $6,962 | $5,125 | $4,411 | $3,117 | $2,178 |

| Pennsylvania | $6,002 | $5,084 | $4,452 | $3,713 | $2,822 |

| Rhode Island | $10,632 | $7,726 | $6,598 | $4,628 | $3,331 |

| South Carolina | $6,370 | $5,662 | $5,099 | $3,754 | $2,742 |

| South Dakota | $5,457 | $4,542 | $4,130 | $3,067 | $2,399 |

| Tennessee | $6,125 | $5,017 | $4,307 | $2,871 | $2,097 |

| Texas | $7,703 | $6,051 | $5,414 | $4,079 | $2,965 |

| Utah | $6,625 | $5,296 | $4,637 | $3,252 | $2,368 |

| Vermont | $3,560 | $3,221 | $2,906 | $2,666 | $1,708 |

| Virginia | $4,408 | $3,720 | $3,255 | $2,553 | $1,875 |

| Washington | $5,523 | $4,291 | $3,689 | $3,038 | $2,226 |

| Washington D.C. | $7,345 | $6,366 | $5,593 | $4,038 | $2,944 |

| West Virginia | $6,301 | $5,170 | $4,527 | $3,761 | $2,543 |

| Wisconsin | $6,851 | $5,242 | $4,630 | $2,987 | $2,064 |

| Wyoming | $6,385 | $5,261 | $4,801 | $3,605 | $2,898 |

Note: Costs are based on 2023 rate data.

Car Insurance for Teens and Young Drivers: Rates by Provider

On average, 21-year-old drivers pay about $2,786 annually for full-coverage car insurance, which is 60% lower than the average rate of $6,912 paid by 16-year-old drivers. Among the top insurance providers we’ve reviewed, Erie Insurance offers the most competitive rates for teen drivers, coming in at over 50% below the market average.

| 16 | 17 | 18 | 19 | 21 | |

|---|---|---|---|---|---|

| Erie Insurance | $3,410 | $3,137 | $2,888 | $2,549 | $2,103 |

| Auto-Owners Insurance | $3,533 | $3,207 | $2,923 | $2,558 | $2,074 |

| State Farm | $4,146 | $3,714 | $3,340 | $2,924 | $2,322 |

| Geico | $4,466 | $3,646 | $3,161 | $2,485 | $1,844 |

| Nationwide | $4,567 | $4,238 | $4,132 | $3,552 | $2,147 |

| USAA | $4,784 | $3,398 | $2,897 | $2,261 | $1,609 |

| American Family | $4,888 | $4,210 | $3,641 | $3,165 | $2,469 |

| Market average | $6,912 | $5,612 | $4,958 | $3,708 | $2,786 |

| Travelers | $7,206 | $5,277 | $4,429 | $3,570 | $2,513 |

| Allstate | $8,350 | $6,804 | $5,925 | $4,188 | $3,302 |

| Progressive | $11,174 | $9,457 | $7,812 | $4,258 | $2,872 |

| Farmers | $12,429 | $8,613 | $7,965 | $4,705 | $3,295 |

Note: Costs are based on 2023 rate data.

What Affects Car Insurance Costs for New Drivers?

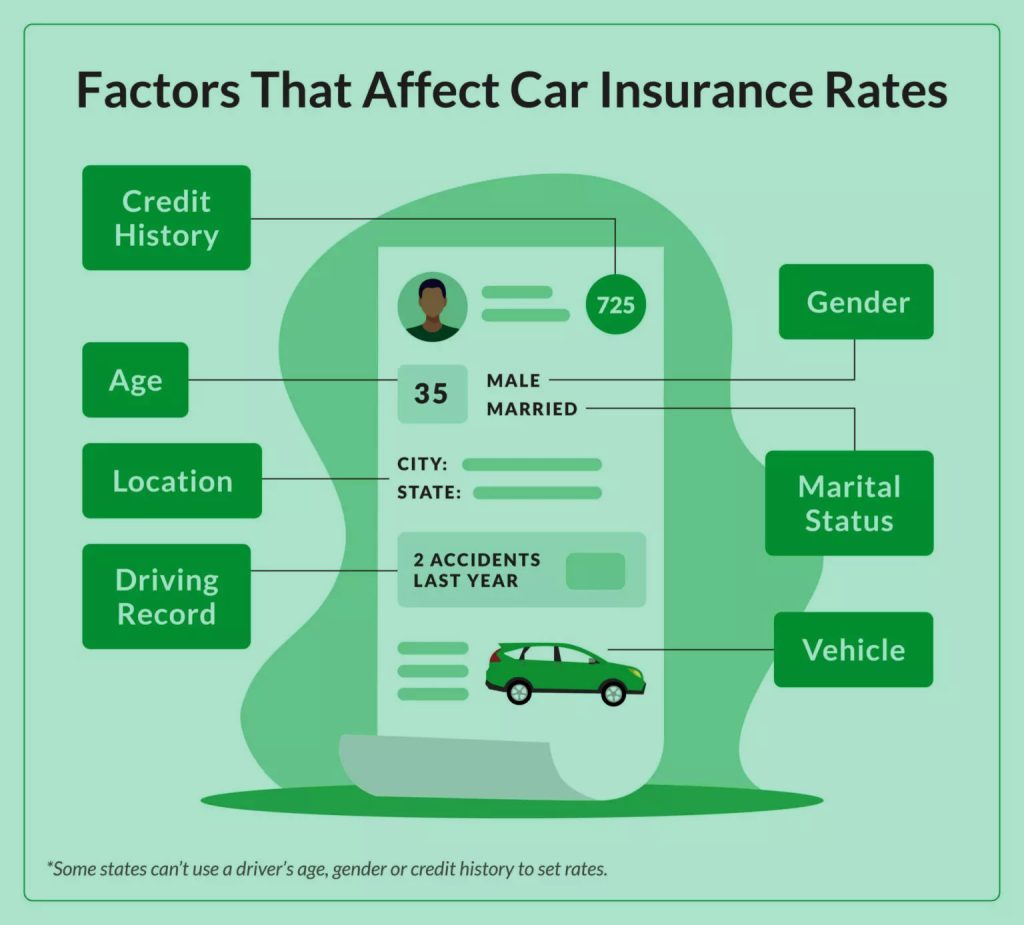

As previously mentioned, both age and driving records influence insurance costs, but insurers also consider various other factors. Local insurance requirements and characteristics such as the gender listed on the driver’s license in many states can affect premiums.

Below are the factors insurance companies consider when calculating premiums, which may vary based on your state of residence:

- Vehicle make and model

- Mileage

- Age

- Location

- Driving history

- Credit score

- Coverage limits

- Deductible amounts

Car Insurance companies for Teens and Young Drivers: Top Providers

After analyzing over 100 car insurance companies, our research team has identified the top five providers offering car insurance tailored for teens and young drivers:

1. State Farm: Best for Customer Experience

State Farm stands out as our top recommendation for new drivers of all ages due to its comprehensive coverage, attractive discounts, and exceptional customer service. The company offers usage-based insurance plans and significant discounts for students with good grades. With a highly-rated mobile app and a broad service network covering nearly every state, State Farm holds the title of the largest auto insurance provider in the U.S. as of 2023.

Why We Recommend State Farm:

- Over a century of industry expertise

- High customer satisfaction and reviews

- Specialized rates and programs for inexperienced drivers

Explore rates, coverage options, and more in our detailed State Farm insurance review.

2. USAA: Ideal for Military Members

USAA specializes in providing insurance exclusively for active and retired military personnel and their families. Ranked as the fifth-largest private insurance provider in the U.S. and the seventh largest overall, USAA offers below-average rates across a wide range of coverage options, all supported by outstanding customer feedback.

Why We Recommend USAA:

- Competitive coverage rates

- Availability of insurance add-ons

- Tailored insurance options for active-duty military members, veterans, and their families

Learn about insurance bundle discounts, the usage-based SafePilot® program, and more in our comprehensive USAA insurance review.

3. Geico: Ideal for Budget-Conscious Drivers

As the nation’s third-largest auto and overall insurance provider, Geico offers competitively priced policies tailored for new drivers. With nearly 20 different discount opportunities available, most drivers, especially young ones, can find ways to lower their premiums. Geico’s DriveEasy program, a usage-based insurance add-on, encourages new drivers to maintain safe driving habits by offering rate discounts in return.

Why We Recommend Geico:

- User-friendly mobile app

- Rates below the national average

- Extensive discounts and a user-friendly usage-based insurance program

Explore detailed insights into insurance options, average rates, and more in our comprehensive Geico insurance review.

4. Erie Insurance: Top Choice for Basic Insurance Coverage

While Erie Insurance is available in only 12 states and Washington, D.C., it has emerged as the 13th largest auto insurance provider in the U.S. and the 19th largest overall. We’ve recognized it as the best option for basic insurance coverage due to its affordable minimum liability rates—$390 annually or $33 monthly, which are nearly 40% lower than the national averages of $627 annually or $52 monthly. Erie offers discounts for young drivers, car safety features, and reduced usage, making it an appealing choice for new drivers within its coverage areas.

Why We Recommend Erie Insurance:

- Cost-effective basic coverage

- Erie Rate Lock® to prevent rate hikes

- Diminishing deductible and a variety of discounts available

Discover customer reviews, coverage options, and other vital details in our detailed Erie insurance review.

5. Liberty Mutual: Best Programs for Young Drivers

Rounding off our top five list is Liberty Mutual, offering multiple discount opportunities tailored for young drivers, including:

- Teen Driving Program Discount: Drivers under 21 completing an approved driving course qualify for a discount.

- Good Student Discount: Students under 25 maintaining a B average can save on premiums.

- New Teen Driver Discount: Adding a teen driver to your policy results in a premium discount.

- Distant Student Discount: If your child resides at school and occasionally drives your car, you’re eligible for a discount.

Liberty Mutual’s usage-based programs enable young drivers to convert safe driving practices into savings, while its various coverage options ensure vehicle repair costs are covered.

Why We Recommend Liberty Mutual:

- Extensive service coverage

- Diverse range of coverage options and add-ons

- Generous discounts for young or inexperienced drivers

For an in-depth analysis of customer feedback, coverage options, and more, check out our comprehensive Liberty Mutual insurance review.

Compare best car insurance companies for teens

| Company | Average annual rate for teens | CRASH Network score | Level of complaints | Rating | LEARN MORE |

|---|---|---|---|---|---|

| Nationwide | $2,819 | C | Low | 5.0 stars | Compare Quotes

Compare quotes offered by participating partners |

| Erie | $3,215 | A- | Low | 5.0 stars | Compare Quotes

Compare quotes offered by participating partners |

| USAA | $3,025 | C- | Low | 4.5 stars | Compare Quotes

Compare quotes offered by participating partners |

| Travelers | $3,963 | C | Low | 4.0 stars | Compare Quotes

Compare quotes offered by participating partners |

| Westfield | $4,248 | B | Very low | 4.0 stars |

Compare quotes offered by participating partners |

| Progressive | $3,864 | C | Low | 3.5 stars | Compare Quotes

Compare quotes offered by participating partners |

| Geico | $3,866 | C- | Low | 3.5 stars | Compare Quotes

Compare quotes offered by participating partners |

| Auto-Owners | $4,209 | B | Very low | 3.5 stars | Compare Quotes

Compare quotes offered by participating partners |

| State Farm | $4,078 | C | Low | 3.0 stars | Compare Quotes

Compare quotes offered by participating partners |

| Mercury | $4,598 | C | Low | 2.5 stars | Compare Quotes

Compare quotes offered by participating partners |

| Safe Auto | $5,948 | C- | Very High | 1.0 stars | Compare Quotes

Compare quotes offered by participating partners |

| Allstate | $5,955 | D+ | Low | 1.0 stars | Compare Quotes

Compare quotes offered by participating partners |

| Farmers | $6,918 | C | Low | 1.0 stars | Compare Quotes

Compare quotes offered by participating partners |

Who has the best car insurance for teens?

Our analysis indicates that Nationwide offers the best car insurance options for teenage drivers, closely followed by Erie.

Both companies provide competitive pricing and a range of features tailored to young drivers, including accident forgiveness, gap insurance, and new car replacement coverage.

Nationwide provides usage-based car insurance (UBI), allowing you to monitor your teen’s driving habits. Importantly, rates remain unaffected by any risky driving behavior, allowing you to encourage safer driving habits without fear of rate increases.

On the other hand, Erie doesn’t offer UBI but provides the YourTurn app, enabling you to track your teen’s driving habits to ensure adherence to safe driving practices. Additionally, safe driving behaviors can earn drivers aged 16 to 23 up to $10 every two weeks.

Erie also boasts the highest rating from CRASH Network, an organization that evaluates insurers based on feedback from collision repair professionals. This rating considers factors such as repair quality, payment efficiency, and customer satisfaction.

For those prioritizing affordability, Nationwide and Erie are strong contenders. However, USAA, catering to the military community, also offers competitive rates, ranking second lowest for teens under parent policies and third lowest for independent teen policies.

How much does car insurance for teens cost?

Our analysis reveals that the average annual cost for adding a teen driver to a parent’s car insurance policy is approximately $4,457. In contrast, the national average for a teen having their own policy stands at a staggering $5,232 per year. Thus, opting to include a teen on a parent’s policy proves to be a more cost-effective choice compared to them securing their own coverage.

The actual premium you or your teen will pay can be influenced by various factors, including:

- Insurer: Insurance companies can offer significantly different rates, making it essential to compare quotes from multiple providers before making a decision.

- Age: Younger drivers typically face higher premiums due to their limited driving experience.

- Gender: Insurance rates can also differ based on gender, with some companies charging higher premiums for male drivers.

- Vehicle Make and Model: The type of vehicle being insured can impact the premium, with sports cars generally commanding higher rates.

- Driving Record: A clean driving history can lead to lower premiums, while traffic violations and accidents can result in increased rates.

- Location: Where you reside can influence insurance costs, with urban areas often having higher premiums due to increased risk factors.

Insurer Comparison

Based on our findings, USAA and Erie offer the most affordable car insurance options for teenage drivers. However, many insurers listed below provide coverage rates below the national average, underscoring the importance of comparing quotes to find the best fit for your needs.

Average cost of car insurance for teens by company

| Car insurance company | Our rating | Teen on parent policy | Teen on own policy | Level of complaints | LEARN MORE |

|---|---|---|---|---|---|

| Nationwide | 5.0 stars | $2,819 | $3,834 | Low |

Compare rates offered by participating partners |

| Erie | 5.0 stars | $3,215 | $2,921 | Low |

Compare rates offered by participating partners |

| USAA | 4.5 stars | $3,025 | $3,418 | Low |

Compare rates offered by participating partners |

| Travelers | 4.0 stars | $3,963 | $4,005 | Low |

Compare rates offered by participating partners |

| Westfield | 4.0 stars | $4,248 | $4,330 | Very low |

Compare rates offered by participating partners |

Age

Young drivers often face exorbitant insurance premiums due to their age, typically signaling limited driving experience. This lack of experience renders them more susceptible to distracted driving incidents. The National Highway Traffic Safety Association highlights that teens who engage in texting while driving amplify their accident risk by 23 times.

However, a teen who obtains a license at 16 and maintains a clean driving record can anticipate substantially reduced insurance rates by the age of 19.

Average Car Insurance Costs for Teens and Young by Age

| DRIVER AGE | TEEN AND YOUNG ON PARENT POLICY | TEEN ON OWN POLICY |

|---|---|---|

| 16 |

$4,951

|

$8,572

|

| 17 |

$4,530

|

$6,836

|

| 18 |

$4,198

|

$6,133

|

| 19 |

$3,769

|

$4,621

|

Gender

Data from the CDC indicates that male teenage drivers are more prone to engaging in risky driving behaviors, such as driving under the influence or speeding. They also account for a majority of fatal accidents involving teens, with male drivers representing two-thirds of teen-related fatalities. Consequently, insurance companies often impose higher premiums for male drivers.

While gender-based pricing is prevalent across the U.S., several states prohibit this practice: California, Hawaii, Maine, Massachusetts, Michigan, North Carolina, and Pennsylvania.

Vehicle Make and Model

Regardless of age, the vehicle you or your teen drives significantly influences insurance premiums. Factors such as repair or replacement costs, safety ratings, and theft risk all play a role in determining rates.

Considering a new vehicle? Explore the most affordable cars to insure.

Driving Record

Young drivers typically face elevated insurance premiums due to their limited driving experience and consequently, lack of a driving history. However, any accidents or traffic violations can further escalate these rates during policy renewals.

Location

Insurance costs can vary widely by state and even by ZIP code. For example, drivers in Hawaii and Vermont generally pay considerably less for coverage than those in Florida and Connecticut. Moreover, suburban residents within a state often receive more favorable rates compared to their urban counterparts.

Car Insurance Discounts for Teens and young drivers

Many insurance providers offer discounts tailored for teen and young drivers. Look out for the following discounts aimed at teens and young drivers to potentially lower your premium:

- Good Student Discount: Insurance companies often offer reduced rates for students with good grades. Typically, students must be enrolled full-time and maintain a B average or a 3.0 GPA, though requirements vary by insurer.

- Away-at-School Discount: If a young driver is attending college and leaves their car at home, they might qualify for this discount. Generally, eligibility is determined based on the distance between the student’s campus and the policyholder’s address, with a common threshold being 100 miles or more.

- Driving Education Program Discount: Many insurers provide discounts to teen drivers who complete an approved driver safety course. Establishing good driving habits early can also lead to long-term savings, as insurers often reward a clean driving record maintained over a specific period.

- Multi-Vehicle Discount: Adding another vehicle to your policy could qualify you for a discount.

How to Secure Affordable Car Insurance for Teens and youths

Shop Around

We advise obtaining at least three car insurance quotes before finalizing your decision, whether you’re a teen or an adult. Ensure that each quote is for comparable coverage levels and types. Don’t overlook obtaining a quote from your current insurer, if applicable.

Check for Discounts

Discounts can significantly reduce premiums. While most insurers offer teen-specific discounts, they also provide general discounts. Consider bundling your auto and home insurance, insuring multiple vehicles under one policy, and exploring other potential discounts for household drivers.

Purchase Only Necessary Coverage

Acquire sufficient insurance to meet state requirements. If your teen drives a financed or leased vehicle, adhere to any insurance stipulations in the lease or loan agreement. After meeting these obligations, decide on additional coverage types.

For example, collision and comprehensive coverage may be worthwhile for a newer car, protecting against damage from accidents or theft. Conversely, for older, inexpensive-to-repair vehicles, the added cost of these coverages may not be justified.

Choose the Right Vehicle

Insurance costs vary by vehicle. When considering a new car, obtain quotes for each model under consideration to compare insurance costs.

Additionally, if a high-value or high-risk vehicle, such as a luxury or sports car not intended for your teen’s use, is on your policy, inquire whether excluding your teen from coverage for that vehicle could result in savings.

Why Are Car Insurance Rates Higher for Teens and Young Drivers?

Insurance premiums for teens and young drivers are generally higher due to various factors. Insurance companies consider age and driving experience when determining premiums. Younger drivers with limited or no driving experience are considered high-risk, leading to elevated insurance rates.

Statistical data indicates that younger, inexperienced drivers are more prone to severe accidents. In the United States, car accidents are the leading cause of death among teenagers, as reported by the Centers for Disease Control and Prevention (CDC). The CDC further notes that the risk of accidents is highest during the initial months after obtaining a driver’s license, with drivers aged 16 to 19 being more likely to be involved in accidents compared to any other age group.

According to the Insurance Institute for Highway Safety (IIHS), over 3,000 teens aged 13 to 19 were fatally injured in motor vehicle accidents in 2021. The IIHS also highlighted that young males constituted approximately two-thirds of these fatalities. Per mile driven, drivers aged 16 to 19 have accident rates nearly three times higher than those aged 20 and above.

While teens have a high accident rate, the National Safety Council (NSC) reports that drivers aged 20 to 24 also have a significant number of car accidents.

Do Teen Drivers Need Car Insurance?

It’s essential for all drivers, including teens, to ensure their insurance policies offer sufficient financial protection. Given the higher likelihood of accidents involving teens, increasing coverage limits can be beneficial.

The Importance of Adequate Liability Coverage

Purchasing only the state-mandated minimum liability coverage may not provide adequate protection against potential lawsuits or cover all accident-related expenses, as noted by the Insurance Information Institute (III).

For instance, if a state requires $50,000 in bodily injury coverage per accident and an accident results in $70,000 in medical bills, the driver is responsible for the remaining $20,000. Depending on your assets’ value, increasing coverage to $100,000 or more may be advisable to ensure greater financial security, especially concerning your teen’s driving activities.

Consideration for Accident Forgiveness

Accident forgiveness ensures that your insurance premium remains unchanged after the first at-fault accident on your policy. The availability and terms of “forgiveness” vary by state and insurer, typically requiring a claim-free record for several years or an additional fee to add this feature to the policy.

Given that some insurers offer accident forgiveness at no extra cost while others provide it as an affordable add-on, it could save you money overall if your young driver has an at-fault car accident. This type of insurance isn’t available from every provider.

If a vehicle is financed, maintaining comprehensive and collision coverage is usually mandatory until the loan is fully repaid, regardless of the driver’s age.

Tips for Lowering Car Insurance Costs for Teen Drivers

Although insurance premiums for teen drivers tend to be higher, there are strategies to reduce these costs. Discussing policy expenses with your teen provides an opportunity to instill responsible driving habits and compare quotes for the most competitive rates.

Stay on a Parent’s Policy

Incorporating a teen into an existing insurance policy is generally more cost-effective than purchasing a separate policy for a young driver, as indicated by the Insurance Information Institute (III). Having an experienced driver as the primary policyholder can help qualify for better rates and potentially unlock more discounts. However, adding a teen driver may still result in an increase in your premium.

Seek Out Discounts

To mitigate the rise in premiums associated with adding a young driver, take advantage of available discounts. Insurance companies offer various discount options based on customer demographics and vehicle characteristics.

Here are some common car insurance discounts:

- Good Student: Maintaining a B average or higher in school can lead to savings on insurance premiums.

- Student Away at School: If a student is attending college and rarely uses the car, you may be eligible for a discount.

- Driver’s Education: Completing a driver training course may qualify you for a discount.

- Defensive Driving Course: Participation in a defensive driving course can result in reduced rates.

- Safe Driver: Maintaining a clean driving record and remaining claim-free for several years may lead to lower premiums.

- Multi-Car: Insuring multiple vehicles under a single policy can earn you a discount.

- Multi-Policy: Bundling different insurance policies, such as home and auto, with the same provider can result in savings.

- Safety Features: Equipping your vehicle with safety features like airbags and anti-theft systems may make you eligible for discounts.

Opt for a Higher Deductible

A deductible is the initial amount a policyholder must pay out-of-pocket for a claim before insurance coverage kicks in. Opting for a higher deductible reduces your premium but increases the amount you pay when filing a claim.

While raising your deductible can lower your premium, it’s essential to consider that having a teen driver on your policy might increase the likelihood of filing a claim.

Conclusion on Teen Car Insurance

Young drivers typically face higher insurance premiums due to their lack of driving experience and higher accident rates. Despite these elevated costs, there are multiple strategies to mitigate the expense of insuring a teen driver, including leveraging available discounts, comparing quotes from various providers, and participating in safe driving programs.

Choosing the Right Insurance for First-Time Drivers

Finding the right insurance for a teenage driver involves striking a balance between affordability and comprehensive coverage. Our insurance specialists advise obtaining quotes from multiple insurers and comparing offerings, such as State Farm vs. Geico, to identify the best fit for your coverage requirements.

Compare Auto Insurance Policies

Answer a few straightforward questions, and we’ll handle the rest. Compare Rates

Teen Car Insurance: Frequently Asked Questions

Can You Drive Your Parents’ Car Without Being Insured?

If you frequently drive your parents’ car or reside with them, you must be listed as a named driver on their insurance policy to ensure coverage in case of an accident.

Which Company Offers the Best Insurance for Teen Drivers?

Based on our research, both State Farm and Geico stand out as top choices for teen drivers. They offer student and good driver discounts and have received high customer satisfaction ratings.

What’s the Most Affordable Way to Insure a Teen Driver?

Meeting your state’s minimum liability coverage requirements is the most cost-effective way to insure a teen driver. However, lenders often require additional coverage for financed vehicles, and opting for full coverage provides enhanced financial protection.

How Much Does Car Insurance Cost for Teens?

On average, car insurance for teens ranges from $5,298 annually or $467 monthly for ages 16 to 19. Specifically, 16-year-olds pay around $6,912 annually or $576 monthly, 17-year-olds average $5,612 annually or $468 monthly, 18-year-olds pay $4,958 annually or $413 monthly, and 19-year-olds average $3,708 annually or $309 monthly.

Should I include my teenager in my auto insurance plan?

Adding a teen to a parent’s car insurance policy is typically more affordable than getting a separate policy for them. On average, adding a teen to a parent’s policy costs around $1,951 per year, whereas a separate policy for a teen averages at $6,598 per year – a difference of $4,647 annually. To determine the most cost-effective option, compare insurance quotes from your current provider as well as potential new insurers. You can also get estimates for adding your teen to a specific vehicle.

Which insurer offers the most affordable car insurance for teens?

According to our research, USAA, recognized among the top car insurance companies, offers the most affordable rates for teenage drivers, whether they’re added to a parent’s policy or have their own. However, USAA serves only the military community and their eligible family members. If you’re not eligible for USAA, Erie and Geico are also solid choices for most consumers.

Why do car insurance rates skyrocket for teen drivers?

Car insurance rates for teens are higher due to their lack of driving experience, susceptibility to distractions, and higher crash risk compared to other age groups. Insurance premiums are determined based on risk levels, and teens are generally viewed as high-risk drivers. As teens mature and maintain a clean driving record while avoiding issues like poor credit or coverage gaps, their rates usually decrease. You can reduce insurance costs, including for teen drivers, by comparing quotes, leveraging discounts, buying only necessary coverage, adjusting deductibles and limits, and bundling home and auto policies.

What are the cheapest car insurance options for 16-year-olds?

For a teen included in a parent’s policy, the most affordable insurance companies are: – Nationwide: Average annual cost of $2,819 – USAA: Average annual cost of $3,025 – Erie: Average annual cost of $3,215

Teens buying their own policy might find the best rates with: – Erie: Average annual cost of $2,921 – USAA: Average annual cost of $3,418 – Geico: Average annual cost of $3,746

How much does car insurance typically cost for teens?

Based on our analysis of top national car insurance companies, adding a teen to a parent’s policy averages $4,362 annually. Teens with their own policies pay an average of $5,232 per year. The cost for your teen’s coverage will vary based on factors like age, gender, location, and the vehicle they drive.

Can I reduce my teen’s auto insurance rates?

You can lower your teen’s insurance premiums by comparing quotes, seeking out discounts specifically for young or teen drivers, and choosing a car that’s cheaper to insure. Policy adjustments, such as raising your teen’s deductible or lowering coverage limits, can also help reduce rates, but be aware that these changes could increase your out-of-pocket expenses if your teen has an accident.

What factors influence car insurance rates for teens and young drivers?

Several factors can impact car insurance rates for teens and young drivers, including age, gender, location, coverage type and amount, choice of insurer, and the vehicle being insured.

Our Research Methodology

To ensure we provide reliable and unbiased information, we developed a comprehensive rating system to rank the best car insurance companies. Our team assessed data from numerous auto insurance providers based on various criteria to generate an overall rating for each company.

Factors Considered in Our Ratings:

- Cost: We factored in auto insurance rate estimates from Quadrant Information Services and available discounts.

- Coverage: Companies offering diverse insurance coverage options ranked higher due to their ability to meet varied consumer needs.

- Reputation and Experience: We evaluated market share, industry expert ratings, and years in business.

- Availability: Insurers with broader state coverage and fewer eligibility constraints scored higher in this category.

- Customer Experience: This rating considered complaint volume from the NAIC, customer satisfaction ratings from J.D. Power, and our own analysis of customer service responsiveness, friendliness, and helpfulness.

Our Credentials:

- Research Time: 800 hours

- Companies Reviewed: 45

- Consumer Surveys Conducted: Over 8,500

Data accurate as of the publication date.